In the kaleidoscope of digital currencies, each with its distinctive capabilities and challenges, TRON has carved its niche. Launched by Justin Sun, TRON is a decentralized platform aiming to establish a global free content entertainment system utilizing blockchain and distributed storage technology. This article endeavors to untangle our latest TRON price prediction and comprehend its implications for prospective investors.

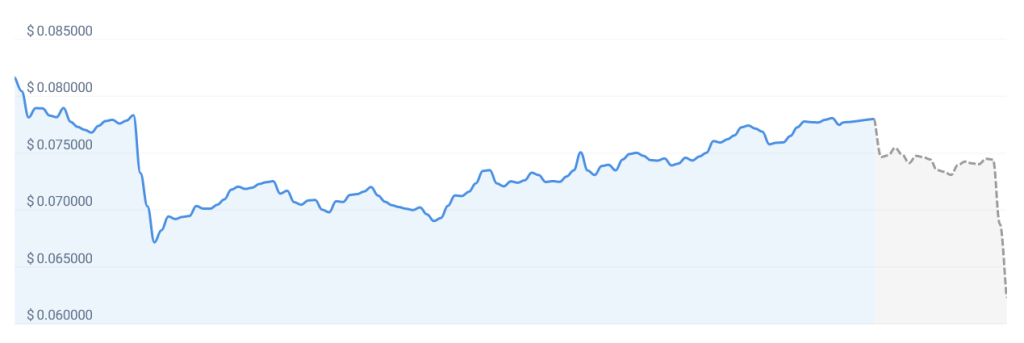

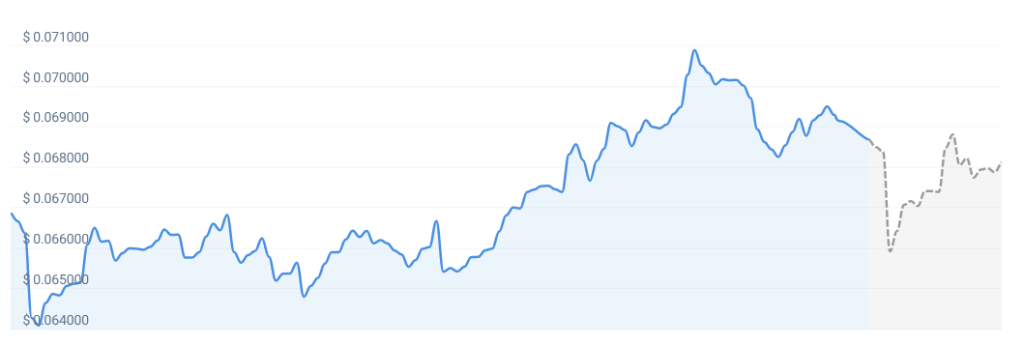

As per our current prognosis, the value of TRON is anticipated to decrease by about -19.91%, reaching around $0.062413 by July 10, 2023. It’s important to note that this prediction is based on a range of technical indicators and previous market behavior. Nonetheless, given the inherently unpredictable nature of cryptocurrencies, such price fluctuations should not come as a surprise.

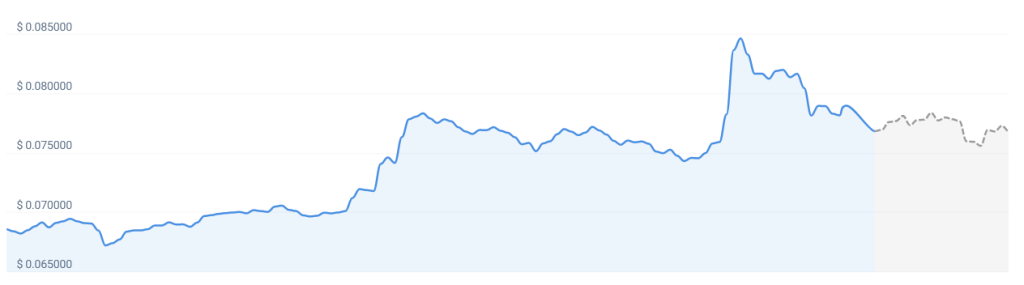

An intriguing aspect of the current TRON market scenario is the bullish sentiment that our technical indicators are reflecting. This indicates that the market participants might be favoring buying over selling, often symbolizing optimism or confidence in the asset’s short-term performance. In the cryptocurrency sphere, a bullish sentiment can often be prompted by factors such as positive broader market trends, promising technological developments, or favorable regulatory news.

Yet, this bullish sentiment exists in stark contrast with the projected price drop, underscoring the inherent complexities of the cryptocurrency market. Adding to this paradoxical scenario is the Fear & Greed Index for TRON, which currently stands at 61, firmly in the ‘Greed’ category. A high Fear & Greed Index suggests that investors are presently motivated by the potential of high returns, despite the perceived risks. This often indicates a level of market overconfidence that might precede a correction.

Over the past 30 days, TRON has had a fairly balanced performance, with 15 out of 30 days, or 50%, being ‘green days.’ A ‘green day’ signifies a day when the cryptocurrency’s price has risen from the previous close. Despite this balanced outlook, TRON has experienced a price volatility of 4.20% over the last month. While such volatility is typical in the cryptocurrency market, it underlines the risk and uncertainty associated with these investments.

Given these conditions, our current TRON forecast suggests that now might be a favorable time to invest in TRON, despite the predicted drop. The bullish sentiment, combined with a high Fear & Greed Index and a balanced monthly performance, indicate potential long-term growth. However, the forecasted price drop should serve as a reminder that short-term losses may need to be weathered for potential long-term gains.

For those who believe in TRON’s long-term potential, this predicted price drop might present an opportunity. The anticipated decrease could provide a more attractive entry point for investors willing to endure short-term volatility in hopes of future profitability. Cryptocurrency history is replete with instances of significant rebounds following substantial drops.

In conclusion, investing in TRON, like any cryptocurrency, requires diligent research, a keen understanding of market dynamics, and a readiness to adapt to rapidly changing conditions. While TRON’s price may be projected to drop in the near term, the broader outlook, considering the bullish sentiment and the Fear & Greed Index, suggests potential for future growth. Cryptocurrency investment is not for the faint-hearted, but for those who can navigate its peaks and troughs, it can be a rewarding endeavor. In the complex world of digital currencies, being informed, patient, and adaptable are essential traits for investors to possess.